-

How will the economy of Canada impact your registered accounts?

Read more »: How will the economy of Canada impact your registered accounts?Economic downturns can shake more than just the stock market — they can derail your retirement plans. RRSPs, while popular, are often exposed to market volatility and come with penalties for early withdrawals. Many Canadians have learned the hard way that traditional savings strategies can be inflexible when real-life emergencies strike. Rethinking where and how…

-

The Biggest Fears Of Registered Retirement Savings Plans

Read more »: The Biggest Fears Of Registered Retirement Savings PlansIt’s important to know what the main fears of Canadians are about RRSPs to be prepared and well-informed when it comes time to make decisions about your retirement planning.

-

Is A Group RRSP Considered Employee Benefits?

Read more »: Is A Group RRSP Considered Employee Benefits?Group RRSPs are a common but often overlooked employee benefit that can offer a convenient way to save for retirement—especially with employer contributions or matching incentives. While the automatic payroll deductions can simplify investing, there are often eligibility rules, restrictions on access, and limited investment options. Understanding how your group RRSP fits into your overall…

-

Five Things You Should Know About Registered Retirement Income Funds

Read more »: Five Things You Should Know About Registered Retirement Income FundsWhile RRSPs help you grow savings tax-deferred, RRIFs require you to start drawing income and paying taxes, often affecting government benefits and estate planning. Understanding how and when to convert your RRSP into a RRIF is key to avoiding costly surprises.

-

Why you don’t need a professional certification in financial services

Read more »: Why you don’t need a professional certification in financial servicesMany Canadians believe credentials are required to make sound financial decisions, but experience, communication, and a proven track record often matter more.

-

Planning Your Financial independence

Read more »: Planning Your Financial independenceTo achieve financial independence, you have to plan your financial course with care. It is not an easy task since there are no one-size-fits-all formulas that you can follow because the variables keep changing. However, there are actionable steps you can take.

-

What should every Canadian Know about Your Will?

Read more »: What should every Canadian Know about Your Will?Do you want to control the allocation of your property even after your death? Well, a will is an excellent way of achieving this. Creating a will is not a walk in the park. There are several things that every Canadian should know about a will. First and foremost, it’s essential to understand that your…

-

Debt management: Budgets, Options, Consolidation, Creditors

Read more »: Debt management: Budgets, Options, Consolidation, CreditorsDebt management is a process typically spearheaded by a financial counselor who helps individuals who find themselves spiraling in debt, particularly unsecured debts such as credit card debt.

-

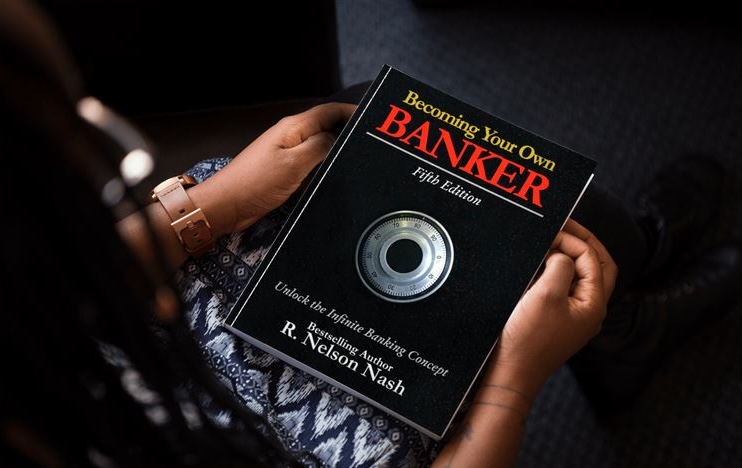

What is Family Economics

Read more »: What is Family EconomicsFamily economics isn’t just about budgets—it’s about the decisions that shape your family’s financial future. From youth sports to building a lasting legacy, how you spend today affects what you leave behind tomorrow. Discover how families across Canada are creating long-term prosperity through a new way of thinking: the family banking system.

-

How To Handle Beneficiaries During Divorce

Read more »: How To Handle Beneficiaries During DivorceDivorce is a major life transition—and amid the legal and emotional complexity, updating your life insurance beneficiaries often gets overlooked. Whether your ex is still listed as your primary beneficiary or your children need a trustee, now is the time to ensure your policies reflect your new reality. Learn how to protect your assets and…

-

Beneficiary of inheritance: What to do, Pay debts

Read more »: Beneficiary of inheritance: What to do, Pay debtsCanada is in the middle of an unprecedented $1 trillion wealth transfer—and if you’re a beneficiary, what you do next matters more than ever. Inheriting money is more than a financial event; it’s a moment to pause, reflect, and plan with purpose. Learn how to preserve and grow your inheritance while honoring the legacy behind…

-

Return On Investments in Canada

Read more »: Return On Investments in CanadaUnderstanding Return on Investment (ROI) goes far beyond simple math—it’s about measuring value in real, personal, and financial terms. Learn how ROI can guide your financial decisions in business and life, and why emotional or lifestyle returns sometimes matter just as much as the numbers.