Did you know that you can get a dividend-paying whole life insurance policy that you can borrow against? In participating whole life insurance policies, policyholders receive non-guaranteed dividends that they can reinvest in their policy to compound its growth. This allows you to help fund major expenses or strategic opportunities as well as nice-to-have investments.

Policyholders who use Infinite Banking can retain these dividends within their policy to enhance the policy’s cash value (which they can borrow against during their lifetime) and increase the available death benefit for beneficiaries.

There are several ways to utilize the annual dividends your insurance company may provide. Using these dividends in a participating policy is central to the Infinite Banking Concept, and doing so can enhance your wealth strategy.

In this article, we’ll help you understand where life insurance dividends come from and how to use them to grow your policy’s value.

What Are Life Insurance Dividends?

Each year, the insurance company calculates its surplus, and a portion of these profits is distributed to active policyholders as dividends. In Infinite Banking, dividends are your share of your mutual life insurance company’s profits. When you own a participating whole life insurance policy, you’re not just a policyholder—you’re a co-owner of the company. Policyholder dividends are a share of the company’s profits you receive as a part-owner of the company.

These dividends can vary from year to year and are not guaranteed. However, most reputable mutual companies have a strong track record of paying them consistently. Dividends are declared annually based on the insurance company’s performance, and once declared, they are contractually guaranteed and cannot be repossessed or lose value. Knowing this can help you maximize the performance of your insurance policy, the value of your whole life insurance policy, and the available cash value you can borrow against.

Those who use Infinite Banking often utilize these life insurance dividends to purchase Paid-Up Additions (PUAs) for their policy, which increases their cash value and death benefit. This helps your policy grow faster over time, and you benefit from compounding value increases.

How Do Dividends Work in Participating Whole Life Policies?

Dividend payments are not guaranteed, and their amount is based on many factors:

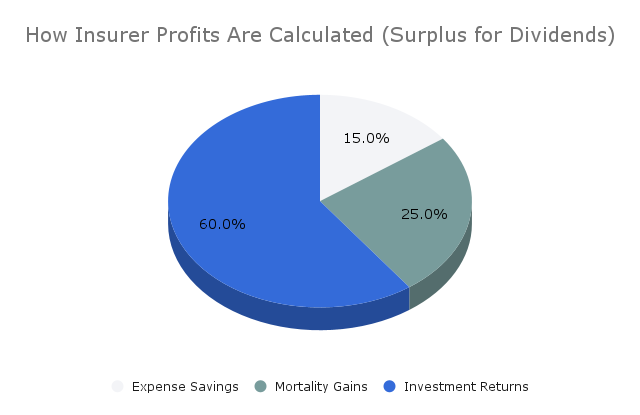

Company Performance: The more profitable the insurance company is in a given year, the higher your dividend payments may be. Profits are determined by:

Surplus earnings on the insurance company’s investments (bonds and other fixed-income assets).

Mortality experience, if less than projected death benefit values are paid out (in other words, fewer policyholders pass away in a given year), there may be more to distribute through dividends.

Operating expenses that are lower than projected, leading to higher profits and a larger dividend pool.

Policy Specific Factors: How much of the dividend pool you receive may vary depending on the size of your policy (higher premiums may earn higher dividends), how long you’ve had your policy, and how you’ve chosen to receive your dividends.

Mutual Companies vs Stock Companies: Mutual insurance companies are owned by policyholders and typically pay dividends more consistently than stock insurers.

What Are Annual Dividend Declarations?

If you have questions about what you can (historically) expect in policyholder dividends from a life insurance company, ask your financial advisor for the insurer’s annual dividend declarations for past years. These dividend policy statements are publicly available, formal announcements outlining how much money is in that year’s dividend pool.

The declaration will include a dividend scale that helps insurers calculate how much each policyholder will receive in dividend payments. This scale takes into account the ratio of company performance, policy-specific factors, and other relevant details. The scale is subject to annual adjustments and is provided to maximize transparency in calculating the dividend payments for each policyholder.

Here is an example of where an insurance company’s profits may come from in a given year:

Take control of your financial future.

Schedule a consultation with Ascendant Financial and ensure your financial choices align with your long-term goals — before it’s too late.

Common Ways to Use Your Dividends

Receiving annual dividends is a valuable opportunity to refine your wealth strategy. Used wisely, they can strengthen your policy’s growth and flexibility, especially if you’re following the Infinite Banking Concept and want to take advantage of compounding growth.

Ask your financial advisor about how and when to use dividends for:

Cash Refunds

You have the option to take your annual dividends as cash. This cash can be tax-free in many jurisdictions if the amount received is less than the policy’s cost basis. This provides you with immediate access to cash, allowing you to use it as you please.

If you need flexibility for extra income outside your policy, this can be beneficial, but you lose the benefits of the compounded growth of your policy’s death benefit and cash value.

Pros

- Provides immediate, tax-free access to cash (as long as dividends don’t exceed premiums paid)

- Offers flexibility for unexpected expenses or supplemental income

Cons

- Sacrifices long-term compounding growth of your policy’s cash value and death benefit

- Reduces the efficiency of your Infinite Banking strategy

Reducing Your Premiums

You can automatically apply your dividends to lower your policy premiums. This helps you reduce your out-of-pocket expenses for your policy, and can be used in years when you need to reduce expenses.

If you need to temporarily lower your costs, this can be an attractive option, but it’s less effective for compounding growth, and your policy will grow more slowly compared to other dividend use options.

Pros

- Lowers out-of-pocket expenses for your policy, freeing up cash flow

- Useful during financial hardship or when you need to redirect funds elsewhere

Cons

- Slows the growth of your policy’s cash value and death benefit compared to reinvesting dividends.

- Less effective for maximizing long-term wealth-building

Purchasing Paid-Up Additions (PUAs)

Apply your policyholder dividends to purchase these PUAs that are above and beyond your premium payments. These increase your death benefit and cash value while maximizing long-term growth, future borrowing power, and compounded growth. When dividends are used to purchase PUAs, there is no taxable event triggered, which is a key advantage of reinvesting dividends within the policy.

This option is ideal if you want to maximize the value of your policy above your regular premium payments.

Pros

- Maximizes cash value and death benefit growth through compounding.

- Increases borrowing power and aligns with Infinite Banking principles.

Cons

- Requires a long-term mindset

- Benefits are realized over time, not immediately.

Learn more about purchasing PUAs.

Leaving with Insurer to Accrue Interest

You can ask that your dividend payments stay with your insurer, in a separate account to earn interest. This interest grows tax-deferred but may be taxable when withdrawn.

This option is used by policyholders who are more conservative and want an additional, lower-risk side investment. Keep in mind, funds used in this way won’t increase the value of your policy and may be taxable when you cash out this side investment account.

Pros

- Provides a conservative, low-risk option for growing funds outside the policy.

- Funds grow tax-deferred and can act as a reserve account.

Cons

- Does not increase the policy’s cash value or death benefit.

- Interest earned may be taxable when withdrawn, depending on the jurisdiction.

Repaying Policy Loans

If you’ve borrowed from the cash value of your policy, you can use dividends to repay this loan. It can reduce the interest you pay over time and free up your policy value faster. Using your dividends in this way would be a strategic move because while you save interest, it will temporarily slow the compounding growth of your policy.

This is ideal if you borrowed a significant amount from your policy’s cash value, but will slow down compounding benefits temporarily.

Pros

- Reduces interest costs on outstanding loans, freeing up cash value for future use.

- Helps restore the policy’s full compounding potential over time.

Cons

- Temporarily slows compounding growth while the loan is being repaid.

- Requires careful planning to avoid over-reliance on dividends for loan repayment.

To ensure you’re using your policy to your greatest benefit, work with an Authorized Infinite Banking Practitioner to design and manage your policies effectively. This ensures that your strategy, including how you use policy dividends, aligns with your financial goals.

Ready to take control of your financial future?

Speak with an Ascendant Financial Advisor today and start building a strategy that protects your legacy.

Life Insurance Dividends and Infinite Banking

Paid-up additions paid through dividend earnings are a core part of how you can build your policy cash value faster (one of the key components of the Infinite Banking Concept). Putting them back into your policy helps you grow your policy cash value and death benefit, taking advantage of compounding growth.

Dividends play a crucial role in increasing the efficiency of your policy and increasing borrowing potential. Remember that dividends are not guaranteed and should be viewed as a performance enhancement rather than a promise. Mutual life insurance companies declare an annual dividend scale interest rate, often in the 4–6% range, but this is not a direct return and is not guaranteed. For example, a smaller policy with premiums of $2,000 might earn $50-$300 in dividends, whereas a larger policy with $20,000 premiums might earn $1,000 to $3,000 in dividends You could earn anywhere from $50 to $3,000 annually in dividend payments. Using these payouts for your policy helps them work harder for you through compounding growth over time.

To give you an example of the benefits of adding dividend earnings back into your policy, meet the Andersen family. They started their policy with an annual premium of $24,000:

- Within 30 days, they accessed $11,906 as a policy loan.

- They used this loan to pay off a $10,000 credit card balance and reduce their line of credit balance.

- They used dividends to purchase PUAs, which accelerated their cash value growth and allowed them to access even more capital annually.

- Their PUAs helped them accumulate enough policy wealth to pay off $200,000 in consumer debt in 44 months, all while building a growing, tax-advantaged asset in the policy.

How you take advantage of your whole life insurance policy and dividends may differ from this family, but the importance of uninterrupted, compounding growth over the long term remains the same.

What Affects Dividend Performance Over Time?

Dividend payouts are not guaranteed and can change every year. For transparency, your insurance company will provide a detailed report of its profits and money added to the shared dividend pool. These amounts will vary based on:

Market interest rates: Falling interest rates could result in smaller dividends, and rising rates could increase your dividends (over a longer period).

Insurance Company Investment Strategy: Your insurer uses some of your premium payments to invest in conservative long-term assets such as bonds. The more profitable their investments, the more money they could add to the dividend pool.

Overall Economic Environment: Inflation can increase your insurer’s expenses, which reduces their profitability and surplus profits to add to your dividend pool.

Company-Specific Financial Strength: An insurance company that finds ways to reduce costs or attract more-than-projected new clients will be more profitable, having more funds to potentially distribute through dividends.

Insurance companies must be transparent about their profits in each of these areas and share how these profits will be distributed to policyholders through a dividend scale. This scale may change over time, which is why dividend payments are difficult to predict and expect with any accuracy.

Should You Rely on Dividends? Expert Considerations

Remember that dividends are typical for policyholders in many whole life insurance policies, but they are not guaranteed. It’s based on the insurer’s profitability that year. As such, relying solely on dividends in your Infinite Banking strategy isn’t recommended.

Relying too heavily on dividends can lead to overestimating their consistency. While reputable mutual companies have a strong history of paying dividends, they’re not guaranteed until declared annually. This means if you’re counting on dividends to fund a specific expense or strategy, you could face challenges if the company adjusts its payout due to economic conditions or lower surplus.

Consider dividends as a bonus that can help you grow your wealth faster. Use dividends as a tool to enhance your strategy, not as the sole driver.

You can set up your policy to automatically use your dividends as PUAs or to lower your premium payments. Talk to your policy advisor to ensure your plan allows for these riders and when you should use them as part of your Infinite Banking Concept.

Learn more about the Infinite Banking Concept in our webinar.

Making Dividends Work for You

Dividends can enhance your wealth-building through the Infinite Banking Concept, but shouldn’t be the foundation of your plan. Create a strategy to take advantage of dividend payments when they arrive while also ensuring your plan is sound even without them.

With Infinite Banking, you can change your dividend strategy as your needs change. We recommend reviewing your needs annually and assessing how to best use any dividends received.

Clients should revisit their dividend option annually, ideally around the policy anniversary. This is when dividends are declared and paid, making it the perfect time to assess whether their current choice—like reinvesting in PUAs or taking cash—still aligns with their financial goals.

For example:

- If you’re struggling to make your premium payments that year, you can divert your dividends to pay for your premium.

- If you’ve borrowed a large sum from your policy cash value, you can use your dividend to repay that loan and save interest.

- If you’re financially comfortable, you can use your dividend to purchase a PUA to enhance your policy’s cash value and death benefit.

There are many ways to use dividend payments in your Infinite Banking Strategy. Talk to your financial Advisor at Ascendant about the best options for your family’s wealth strategy today.

FAQs

What are life insurance dividends?

If your insurance company has a surplus profit, this profit is distributed among qualifying policyholders in the form of an annual dividend payment. In Infinite Banking, this dividend can be put back into your policy to take advantage of faster, compounding growth of your cash value and life insurance payout options like the death benefit.

Are life insurance dividends guaranteed?

Whole life insurance policies may include non-guaranteed dividends. They can vary from year to year, even with the same insurance company. Read the Annual Dividend Declaration from your insurer for more details about how much funding was available each year and the criteria for distribution to policyholders.

How do dividends fit into Infinite Banking?

Dividends from your participating whole life insurance policy can be used in Infinite Banking to offset your premium payments, repay a cash value loan from your policy, or add as a PUA to help your plan grow faster.

Are life insurance dividends taxable?

If withdrawn as cash, life insurance dividends may be taxable if they exceed your premium payments. However, using them to purchase PUA, leaving them in the policy to accumulate, or applying them to reduce your premiums generally avoids taxation. Consult a tax or financial advisor in your region for specific details.

Book a Call with an Advisor at Ascendant Financial

Contact Ascendant Financial today to learn more about the money multiplier and what it means for you.

Popular Posts

- Understanding 401(k) Withdrawal Rules

What do you have planned for your golden years? Having enough money to live comfortably and meet your goals for retirement often starts with your… Read more: Understanding 401(k) Withdrawal Rules

What do you have planned for your golden years? Having enough money to live comfortably and meet your goals for retirement often starts with your… Read more: Understanding 401(k) Withdrawal Rules - Is Infinite Banking Right for You? Pros, Cons, and Insights

Are you ready to take the first step toward financial control and independence? Canadians from across the country are learning how the Infinite Banking Concept… Read more: Is Infinite Banking Right for You? Pros, Cons, and Insights

Are you ready to take the first step toward financial control and independence? Canadians from across the country are learning how the Infinite Banking Concept… Read more: Is Infinite Banking Right for You? Pros, Cons, and Insights

Share This Post

About the Author:

Jayson Lowe

As a seasoned coach, author, and podcast host, Jayson’s insights are rooted in real-world experience and a proven track record of turning challenges into opportunities. He’s not just a speaker—he’s a catalyst for change, inspiring audiences with actionable strategies and the motivation to implement them. Whether you’re looking to ignite your team’s potential, elevate your business strategies, or gain unparalleled insights into entrepreneurship, Jayson Lowe delivers with passion, clarity, and an undeniable impact.

Categories & Tags