Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: The Insured Retirement Planning Guide

Read more »: The Insured Retirement Planning GuideInsured retirement plan (IRPs) Insured Retirement Plans (IRPs) allow you to have your cake and eat it too. In the article, we’ll be exploring what IRPs are, how they work, plus the pros and cons of getting one.

-

Read more »: Understanding 401(k) Withdrawal Rules

Read more »: Understanding 401(k) Withdrawal RulesWhat do you have planned for your golden years? Having enough money to live comfortably and meet your goals for retirement often starts with your employer-sponsored 401(k). This valuable financial tool helps you achieve your financial goals for retirement. Contributions are deducted from your paycheck before taxes and grow tax-deferred throughout your career. When used…

-

Read more »: Understanding Contingent Beneficiary

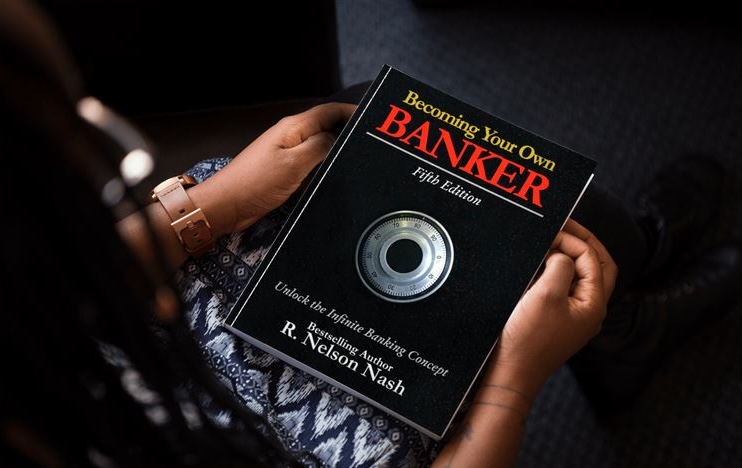

Read more »: Understanding Contingent BeneficiaryThe Infinite Banking concept also known as IBC was pioneered by Nelson Nash. Infinite Banking strategy takes a revolutionary approach toward personal finance. The strategy essentially involves becoming your own bank by utilizing a dividend-paying whole life insurance policy as your bank.

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE 👉 http://watchibc.com/ Infinite Banking offers business owners and families a transformative way to protect and grow wealth by becoming their own banker. This video dives deep into the principles of Infinite Banking, exploring how it promotes financial independence, generational wealth building, and long-term wealth preservation. By leveraging dividend-paying whole life insurance policies, this…

-

CLICK HERE 👉 http://watchibc.com/ As you grow your success in life and business, expanding your personal banking system is essential. The Infinite Banking Concept (IBC) allows you to become your own banker, redirecting cash flow through dividend-paying whole life insurance policies, creating both growth and access to capital. By understanding the four distinct stages—Saver, Capital…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Smart investors create a system that adapts to their financial situation every year. Jason Weiss, a financial strategist, explains how business owners and real estate investors can use premium financing to keep policies growing without interruption. Whether cash flow is tight one year or a bank steps in to fund premiums, the policy stays on…

-

What if you could finance an asset that only grows in value? Unlike cars, boats, or real estate that can lose value over time, a properly structured whole life insurance policy is a guaranteed appreciating asset. Jason Weiss, a financial strategist, explains why premium financing is a game-changer for business owners. Instead of worrying about…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!