Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: Infinite Banking Examples: Understanding the Concept and Its Real-World Application

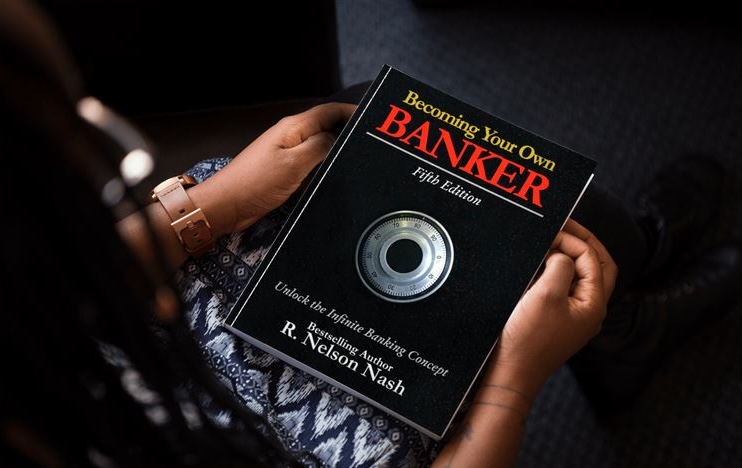

Read more »: Infinite Banking Examples: Understanding the Concept and Its Real-World ApplicationInfinite banking is more than a concept; it’s how you take control of your wealth and financial independence. Until today, you may have relied on traditional banking but felt that you were not in control of your money. Perhaps there was a time you needed cash for an important purchase, but were limited by the…

-

Read more »: Infinite Banking: A Complete Guide to Building Your Own Banking System

Read more »: Infinite Banking: A Complete Guide to Building Your Own Banking SystemEver wondered why banks generate billions in profits while most individuals struggle to build wealth? The answer lies in how banks leverage the flow of money, earning interest on every dollar that passes through their doors. What if you could apply this same principle to your personal finances? Infinite Banking offers a revolutionary approach to…

-

Read more »: Inheritance tax with Ascendant Financial

Read more »: Inheritance tax with Ascendant FinancialWhat is Inheritance tax? The term Inheritance Tax (IHT), stands for an amount that’s payable by a person who has received assets upon another individual’s death. The asset range includes cash, real estate properties, business shares among others. This emphasizes how important it is to understand optimal inheritance tax literature takes into account these factors…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE 👉 http://watchibc.com/ Compounding dividends is one of the most powerful strategies for building long-term wealth. In this video, I’ll break down how dividend reinvestment plans (DRIPs) work, why I only invest in dividend-paying stocks, and how I use the infinite banking concept to maximize returns. By reinvesting dividends into more shares, you can…

-

CLICK HERE 👉 http://watchibc.com/ Welcome back to Bankers Vault! Today, we break down the key concepts of financial independence versus financial freedom and introduce the family banking system as a powerful way to control the banking function in your life. We explain how to free up cash flow through debt recapture, build a sustainable system…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Selling a business is a big milestone—but where will you put that money? Jason Weiss, a financial strategist, explains how premium financing and properly structured whole life insurance policies can serve as the perfect warehouse for liquidity. Instead of parking funds in a bank where they lose value, business owners can use their policies to…

-

Debt doesn’t have to be scary—if you understand how to use it. The wealthy don’t see loans as burdens; they see them as tools for financial growth. Jayson Lowe explains how loans can be managed strategically so they become an asset rather than a liability. By borrowing against a guaranteed appreciating policy, you can access…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!