Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: Is Life Insurance Taxable In Canada?

Read more »: Is Life Insurance Taxable In Canada?If retirement is on the horizon for you or a major milestone you want to achieve, set a clear goal, and plan a reward for achieving it to help motivate you. Instead of planning an age or a date focus on a financial target that will produce the quality of life you are looking for.

-

Read more »: Learn More About Your TFSA Contribution 2022

Read more »: Learn More About Your TFSA Contribution 2022The Tax-Free Savings Account or TFSA has become a very popular investing tool for Canadians. The good news for Canadian families is that each adult can contribute another $6000 into their TFSA accounts this year. That is $6000 in total across all accounts. Indeed, you can have multiple accounts, but you are capped to a contribution max. …

-

Read more »: Life insurance Canada

Read more »: Life insurance CanadaWhat is the definition of Canadian Life Insurance? Life insurance is a contract between the insurance policyholder and the company. If you pass away during the term of the contract, the insurance company promises to pay the death benefit in terms of tax free money to those you designate as beneficiaries. There are many types…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

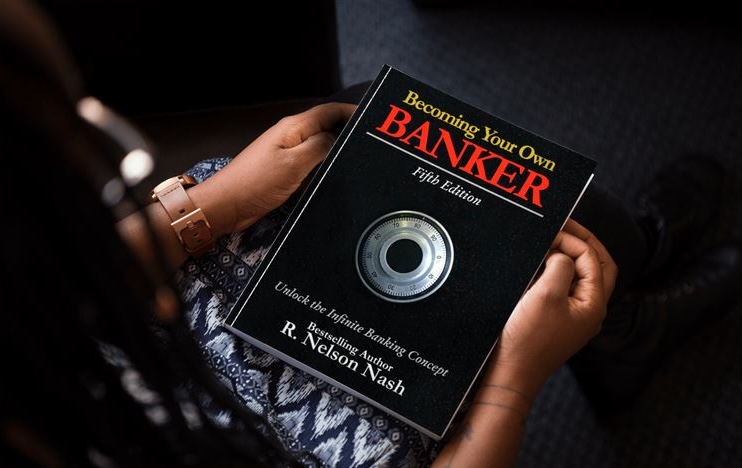

CLICK HERE 👉 http://watchibc.com/ In this episode, Jayson Lowe and Richard Canfield dive into the concepts from their new book, Don’t Spread the Wealth, highlighting how the Infinite Banking Concept (IBC) empowers families to pay off debt and build lasting wealth. They explain how most people unknowingly transfer wealth out of their families through taxes,…

-

CLICK HERE 👉 http://watchibc.com/ Ever feel like your money is slipping through your fingers and straight into the pockets of banks, the IRS, and financial institutions? You’re not alone. In this episode, Jayson Lowe breaks down how the Infinite Banking Concept (IBC) flips the script, putting YOU in control of your wealth instead of handing…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Smart investors create a system that adapts to their financial situation every year. Jason Weiss, a financial strategist, explains how business owners and real estate investors can use premium financing to keep policies growing without interruption. Whether cash flow is tight one year or a bank steps in to fund premiums, the policy stays on…

-

What if you could finance an asset that only grows in value? Unlike cars, boats, or real estate that can lose value over time, a properly structured whole life insurance policy is a guaranteed appreciating asset. Jason Weiss, a financial strategist, explains why premium financing is a game-changer for business owners. Instead of worrying about…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!