Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: How Borrowing Against Life Insurance Really Works

Read more »: How Borrowing Against Life Insurance Really WorksImagine borrowing money without selling assets, visiting the bank, or navigating complicated approval processes. With a properly structured life insurance plan, you can borrow cash anytime, using your policy as collateral. This financial strategy can help you pay for unexpected life expenses or nice-to-have items, such as a new car or vacation home, with more…

-

Read more »: How Can Termination of Employment Affect Your Group RRSP?

Read more »: How Can Termination of Employment Affect Your Group RRSP?From losing employer matching to understanding transfer and withdrawal options, this article helps Canadians navigate their RRSPs post-employment—and why now might be the perfect time to take back control of your retirement strategy.

-

Read more »: How Do Dividends Work?

Read more »: How Do Dividends Work?How Do Dividends Work? Did you know that certain life insurance companies in Canada pay dividends annually to their participating whole life policy owners? Since 1848, Canadians who own these contracts have been receiving annual dividends each year without interruption. Yes, even during the Spanish Flu, the great depression, 30 recessions, H1N1, SARS, the financial…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

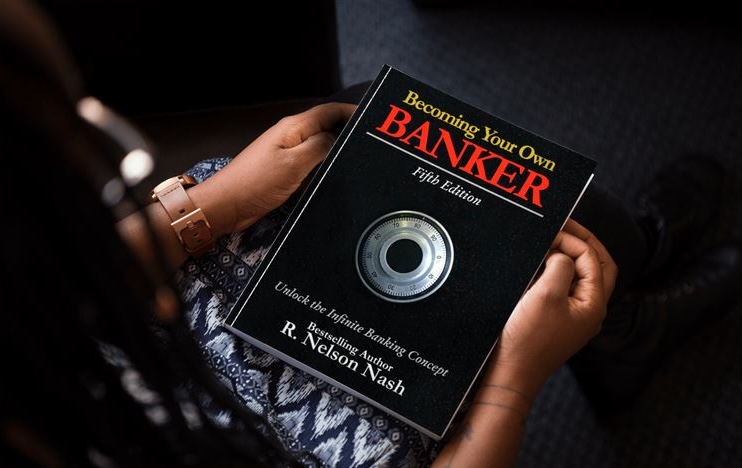

CLICK HERE 👉 http://watchibc.com/ This episode dives into Nelson Nash’s Becoming Your Own Banker and the power of infinite banking using dividend-paying whole life insurance. Jayson and Richard break down key financial principles, including the importance of repaying policy loans, thinking long-term, and keeping money within the family banking system. They contrast traditional banking with…

-

CLICK HERE 👉 http://watchibc.com/ In this episode, we dive deep into the fundamentals of infinite banking and the common misconceptions surrounding cash value life insurance. The discussion centers around R. Nelson Nash’s book Becoming Your Own Banker, emphasizing the difference between purchasing a policy and implementing a banking process. Through the equipment financing example, Jayson…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Treating life insurance as an expense could cost you. Henry Wong breaks down a major misconception that permanent life insurance is a specialized asset, but many mistakenly treat premiums as an expense. As he points out, the Income Tax Act clearly states that insurance premiums aren’t deductible. Avoid costly mistakes and make life insurance work…

-

Every major purchase comes down to three choices: lease it, buy it with cash, or finance it. Jason Weiss, a financial strategist, breaks down how business owners can optimize their cash flow while acquiring assets. Instead of tying up capital, strategic financing allows you to keep money moving where it works best. This approach applies…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!