Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: How to Structure a Whole Life Policy for Infinite Banking

Read more »: How to Structure a Whole Life Policy for Infinite BankingAre you utilizing the most effective financial tools to achieve financial freedom, flexibility, and independence? You no longer need to be at the mercy of the banks and external lenders, and instead can build a “family bank” that you can borrow from. You can leverage a properly structured whole life insurance policy to create your…

-

Read more »: How to Use Life Insurance to Build Wealth

Read more »: How to Use Life Insurance to Build WealthHow to Use Life Insurance to Build Wealth Life insurance isn’t only for protecting your loved ones after you’re gone. If used correctly and responsibly, participating whole life insurance plans can become powerful, generational wealth-building strategies. Infinite Banking and whole life insurance provide a framework for setting up your life insurance policy and utilizing it…

-

Read more »: How Whole Life Insurance Works

Read more »: How Whole Life Insurance WorksWere you taught that life insurance is just another expense? With a properly structured plan, it can be a powerful financial tool to help you pay down debt or finance the life you’ve always dreamed of. Whole life insurance is a permanent insurance policy that not only provides a death benefit for your loved ones,…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

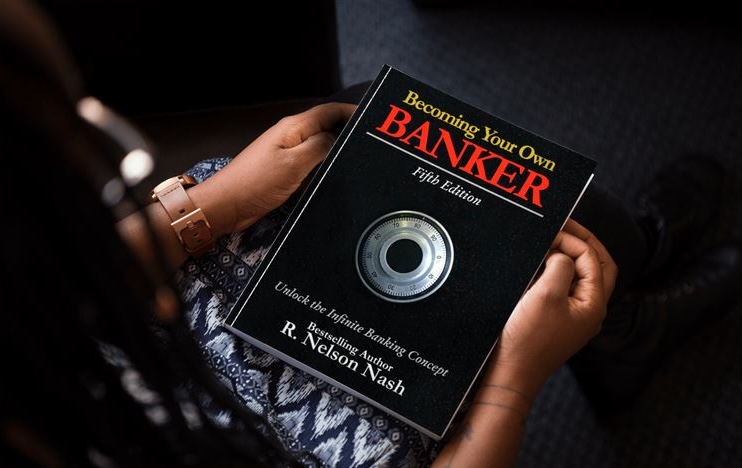

CLICK HERE 👉 http://watchibc.com/ This episode dives into Nelson Nash’s Becoming Your Own Banker and the power of infinite banking using dividend-paying whole life insurance. Jayson and Richard break down key financial principles, including the importance of repaying policy loans, thinking long-term, and keeping money within the family banking system. They contrast traditional banking with…

-

CLICK HERE 👉 http://watchibc.com/ In this episode, we dive deep into the fundamentals of infinite banking and the common misconceptions surrounding cash value life insurance. The discussion centers around R. Nelson Nash’s book Becoming Your Own Banker, emphasizing the difference between purchasing a policy and implementing a banking process. Through the equipment financing example, Jayson…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Treating life insurance as an expense could cost you. Henry Wong breaks down a major misconception that permanent life insurance is a specialized asset, but many mistakenly treat premiums as an expense. As he points out, the Income Tax Act clearly states that insurance premiums aren’t deductible. Avoid costly mistakes and make life insurance work…

-

Every major purchase comes down to three choices: lease it, buy it with cash, or finance it. Jason Weiss, a financial strategist, breaks down how business owners can optimize their cash flow while acquiring assets. Instead of tying up capital, strategic financing allows you to keep money moving where it works best. This approach applies…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!