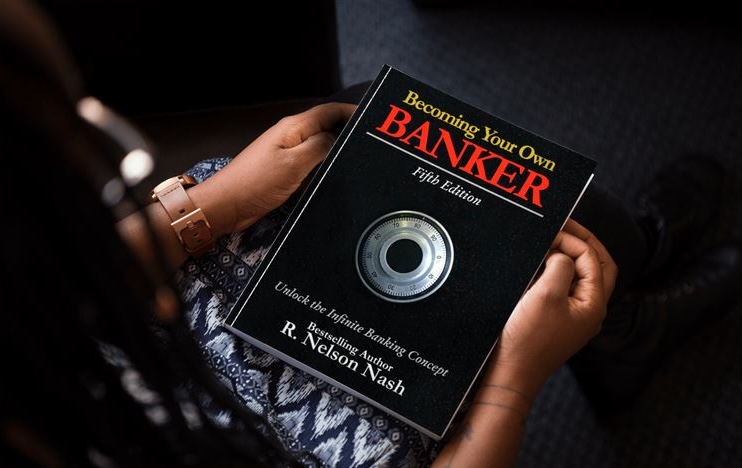

Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: How to Get Started With Infinite Banking: Step-by-Step Guide

Read more »: How to Get Started With Infinite Banking: Step-by-Step GuideReady to take control of your financial future? Tired of traditional banking that seems to benefit everyone except you? Infinite Banking might be the solution you’re seeking. This approach puts you in the banker’s seat, allowing you to build wealth, access capital when needed, and create a legacy for your family. Unlike conventional approaches that…

-

Read more »: How to Get Tax Free Death Benefit

Read more »: How to Get Tax Free Death BenefitIf retirement is on the horizon for you or a major milestone you want to achieve, set a clear goal, and plan a reward for achieving it to help motivate you. Instead of planning an age or a date focus on a financial target that will produce the quality of life you are looking for.

-

Read more »: How To Handle Beneficiaries During Divorce

Read more »: How To Handle Beneficiaries During DivorceDivorce is a major life transition—and amid the legal and emotional complexity, updating your life insurance beneficiaries often gets overlooked. Whether your ex is still listed as your primary beneficiary or your children need a trustee, now is the time to ensure your policies reflect your new reality. Learn how to protect your assets and…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE 👉 http://watchibc.com/ Infinite Banking offers business owners and families a transformative way to protect and grow wealth by becoming their own banker. This video dives deep into the principles of Infinite Banking, exploring how it promotes financial independence, generational wealth building, and long-term wealth preservation. By leveraging dividend-paying whole life insurance policies, this…

-

CLICK HERE 👉 http://watchibc.com/ As you grow your success in life and business, expanding your personal banking system is essential. The Infinite Banking Concept (IBC) allows you to become your own banker, redirecting cash flow through dividend-paying whole life insurance policies, creating both growth and access to capital. By understanding the four distinct stages—Saver, Capital…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Smart investors create a system that adapts to their financial situation every year. Jason Weiss, a financial strategist, explains how business owners and real estate investors can use premium financing to keep policies growing without interruption. Whether cash flow is tight one year or a bank steps in to fund premiums, the policy stays on…

-

What if you could finance an asset that only grows in value? Unlike cars, boats, or real estate that can lose value over time, a properly structured whole life insurance policy is a guaranteed appreciating asset. Jason Weiss, a financial strategist, explains why premium financing is a game-changer for business owners. Instead of worrying about…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!