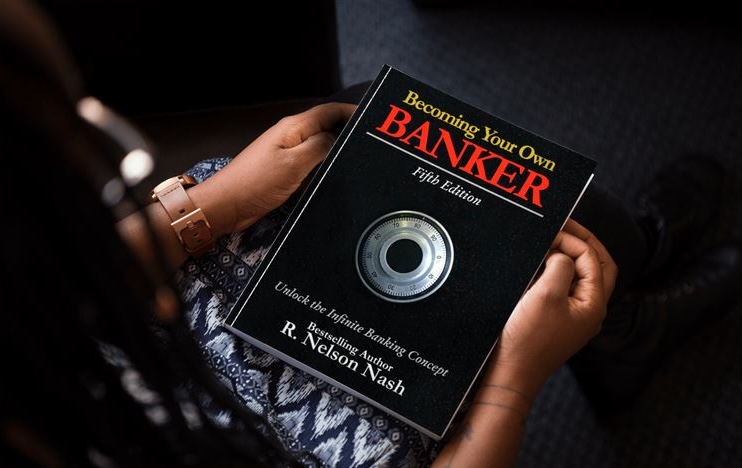

Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: What is Estate planning?

Read more »: What is Estate planning?Estate planning is a critical financial strategy that involves organizing your assets in the most tax advantaged manner, and defining how they’ll be distributed after your death. In a Canadian context, this is a process that requires careful consideration of various legal, tax, and personal factors.

-

Read more »: What is Family Economics

Read more »: What is Family EconomicsFamily economics isn’t just about budgets—it’s about the decisions that shape your family’s financial future. From youth sports to building a lasting legacy, how you spend today affects what you leave behind tomorrow. Discover how families across Canada are creating long-term prosperity through a new way of thinking: the family banking system.

-

Read more »: What is Liability?

Read more »: What is Liability?Understanding liabilities isn’t just about balancing your books — it’s about protecting your income, your family, and your future. From debts like loans and credit cards to the often-overlooked final tax liability, knowing how to manage and plan for these obligations is critical. Learn how life insurance and proper financial planning can provide peace of…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE 👉 http://watchibc.com/ Infinite Banking offers business owners and families a transformative way to protect and grow wealth by becoming their own banker. This video dives deep into the principles of Infinite Banking, exploring how it promotes financial independence, generational wealth building, and long-term wealth preservation. By leveraging dividend-paying whole life insurance policies, this…

-

CLICK HERE 👉 http://watchibc.com/ As you grow your success in life and business, expanding your personal banking system is essential. The Infinite Banking Concept (IBC) allows you to become your own banker, redirecting cash flow through dividend-paying whole life insurance policies, creating both growth and access to capital. By understanding the four distinct stages—Saver, Capital…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Selling a business is a big milestone—but where will you put that money? Jason Weiss, a financial strategist, explains how premium financing and properly structured whole life insurance policies can serve as the perfect warehouse for liquidity. Instead of parking funds in a bank where they lose value, business owners can use their policies to…

-

Debt doesn’t have to be scary—if you understand how to use it. The wealthy don’t see loans as burdens; they see them as tools for financial growth. Jayson Lowe explains how loans can be managed strategically so they become an asset rather than a liability. By borrowing against a guaranteed appreciating policy, you can access…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!