What is Cash Flow banking?

Cashflow Banking or Cash Flow Banking is a strategy used to describe a way to capture the opportunity cost on your cash flow as it moves through your life. The banking aspect refers to the way you can transactionally access this stored cash flow from the cash values of a life insurance contract where it has been accumulated as a reservoir of capital. By stockpiling cash flow into a flexible cash value life insurance contract you create liquidity. When accessed strategically in combination with good habits this can be a revolutionary system for Canadians.

Keep in mind, this type of program only works effectively as long as the policy owner has good habits and a high level of discipline. That is, they can return the capital they have used back to the policy. If this is done effectively the overall values of the cash asset and the estate value can be increased when following some core principles and working with a good coach to assist them.

Cash flow banking pros and cons.

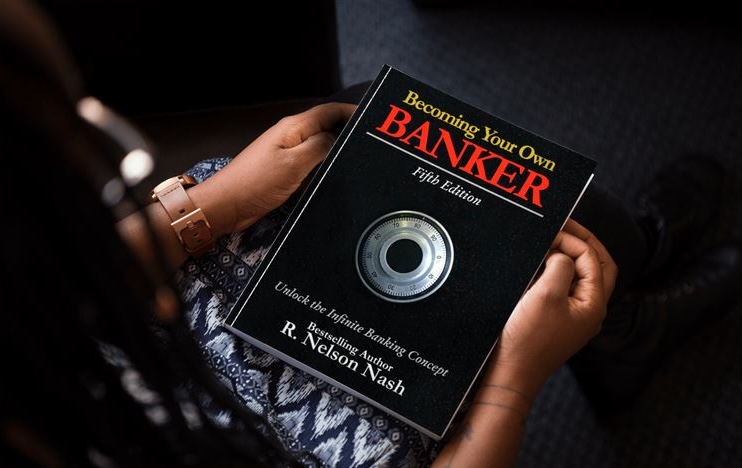

At its core, the Cash flow banking Method is simply put, a popular marketing term used to rebrand or relabel The Infinite Banking Concept created by R. Nelson Nash. Fundamentally the two things are the same. Caution is recommended however, as The Nelson Nash Institute advocates that only Participating Dividend Whole Life is to be used in structuring a life policy to be used for the purpose of IBC.

As cash flow banking is a marketing description there does not appear to be any restrictions on what an advisor may actually recommend to a prospective client for implementing this method. Therefore anyone considering this strategy should research and clearly understand that any life product should be a match for the strategy and confirm that Par Whole life ideally with a Mutual Insurance company is the vehicle they are going to be using to implement the concept.

In 2016 a book was released by bestselling author Garret Gunderson titled, What Would the Rockefellers Do?: How the Wealthy Get and Stay That Way … and How You Can Too.

This popular book has helped many Canadians learn about the cash flow banking method and how to think in terms of keeping money in the family as a system like the Rockefellers family is considered famous for. Since releasing this book Garret Gunderson has continued to educate the public on these principles and helped many discover how the cash flow banking strategy can help them when they overcome certain physiological human factors that require discipline. In this way Garret has helped many discover in a roundabout way the teaching of R. Nelson Nash who pioneered The Infinite Banking Concept many would isolate as the root of cash flow banking.

Discover The Process Of Becoming Your Own Banker!

Speak with an Ascendant Financial Advisor today and start building a strategy that protects your legacy.

Popular Posts

- How to Structure a Whole Life Policy for Infinite Banking

Are you utilizing the most effective financial tools to achieve financial freedom, flexibility, and independence? You no longer need to be at the mercy of… Read more: How to Structure a Whole Life Policy for Infinite Banking

Are you utilizing the most effective financial tools to achieve financial freedom, flexibility, and independence? You no longer need to be at the mercy of… Read more: How to Structure a Whole Life Policy for Infinite Banking - Velocity Banking vs Infinite Banking: Which Wealth Strategy Wins?

Banking is no longer dominated by the banks. People around the world are discovering how to use alternative banking strategies and concepts to regain control… Read more: Velocity Banking vs Infinite Banking: Which Wealth Strategy Wins?

Banking is no longer dominated by the banks. People around the world are discovering how to use alternative banking strategies and concepts to regain control… Read more: Velocity Banking vs Infinite Banking: Which Wealth Strategy Wins?

Share This Post

About the Author:

Jayson Lowe

As a seasoned coach, author, and podcast host, Jayson’s insights are rooted in real-world experience and a proven track record of turning challenges into opportunities. He’s not just a speaker—he’s a catalyst for change, inspiring audiences with actionable strategies and the motivation to implement them. Whether you’re looking to ignite your team’s potential, elevate your business strategies, or gain unparalleled insights into entrepreneurship, Jayson Lowe delivers with passion, clarity, and an undeniable impact.

Categories & Tags