Featured Articles

-

Becoming Your Own Banker

Read more »: Becoming Your Own BankerBecoming Your Own Banker is a financial strategy focused on your benefits, not the banks. A way to grow your financial success using the power of time-tested dividend-paying whole life insurance.

-

Becoming Your Own Banker Training

Read more »: Becoming Your Own Banker TrainingBecoming Your Own Banker is a financial strategy focused on your benefits not the banks benefits. A way to grow your future financial success and the potential of a dividend-paying life insurance. It’s neither a sales nor a marketing tool for whole life insurance brokers.

-

Cash Flow Banking Strategy

Read more »: Cash Flow Banking StrategyWhat is Cash Flow banking? Cashflow Banking or Cash Flow Banking is a strategy used to describe a way to capture the opportunity cost on your cash flow as it moves through your life. The banking aspect refers to the way you can transactionally access this stored cash flow from the cash values of a…

Financial Education

-

Beneficiary of inheritance: What to do, Pay debts

Read more »: Beneficiary of inheritance: What to do, Pay debtsCanada is in the middle of an unprecedented $1 trillion wealth transfer—and if you’re a beneficiary, what you do next matters more than ever. Inheriting money is more than a financial event; it’s a moment to pause, reflect, and plan with purpose. Learn how to preserve and grow your inheritance while honoring the legacy behind…

-

Cash Flow Banking Strategy

Read more »: Cash Flow Banking StrategyWhat is Cash Flow banking? Cashflow Banking or Cash Flow Banking is a strategy used to describe a way to capture the opportunity cost on your cash flow as it moves through your life. The banking aspect refers to the way you can transactionally access this stored cash flow from the cash values of a…

-

Cash Value vs Death Benefit: What’s the Difference and Why It Matters

Read more »: Cash Value vs Death Benefit: What’s the Difference and Why It MattersNavigating the world of life insurance can feel like learning a new language. Two terms you’ll encounter repeatedly are “cash value” and “death benefit” — understanding their distinct roles is crucial for making smart financial decisions. Permanent life insurance policies offer more than just protection after you’re gone. They can serve as powerful financial tools…

Wealth Building

-

Becoming Your Own Banker Training

Read more »: Becoming Your Own Banker TrainingBecoming Your Own Banker is a financial strategy focused on your benefits not the banks benefits. A way to grow your future financial success and the potential of a dividend-paying life insurance. It’s neither a sales nor a marketing tool for whole life insurance brokers.

-

Cash Flow Banking Strategy

Read more »: Cash Flow Banking StrategyWhat is Cash Flow banking? Cashflow Banking or Cash Flow Banking is a strategy used to describe a way to capture the opportunity cost on your cash flow as it moves through your life. The banking aspect refers to the way you can transactionally access this stored cash flow from the cash values of a…

-

Creating A Private Family Banking Strategy

Read more »: Creating A Private Family Banking StrategyWhat is the main cause of concern among wealthy families around the world? Our research shows that families who are remarkably wealthy are keen and deeply concerned about their families’ welfare in the future. They don’t focus only on managing investments of the financial assets they…

Retirement Planning

-

Discover How You Can Create Tax Preferred Retirement

Read more »: Discover How You Can Create Tax Preferred RetirementHow Much Do I Need To Retire? If you are like most people, you may have found your mind wandering occasionally, thinking about what life will be like when you’re ready for the big day … Retirement. All that time to yourself, the freedom to travel when you want to travel, to serve when you…

-

Five Things You Should Know About Registered Retirement Income Funds

Read more »: Five Things You Should Know About Registered Retirement Income FundsWhile RRSPs help you grow savings tax-deferred, RRIFs require you to start drawing income and paying taxes, often affecting government benefits and estate planning. Understanding how and when to convert your RRSP into a RRIF is key to avoiding costly surprises.

-

Individual Retirement Accounts In Canada

Read more »: Individual Retirement Accounts In CanadaWhat are Individual Retirement Accounts? Canada has many types of retirement accounts that are available. The most commonly discussed around the water cooler are the TFSA and RRSP. However, there are many more to note. You may even have one of these or end up with one in the future. There are LIRA accounts which…

Insurance Education

-

Beneficiary of inheritance: What to do, Pay debts

Read more »: Beneficiary of inheritance: What to do, Pay debtsCanada is in the middle of an unprecedented $1 trillion wealth transfer—and if you’re a beneficiary, what you do next matters more than ever. Inheriting money is more than a financial event; it’s a moment to pause, reflect, and plan with purpose. Learn how to preserve and grow your inheritance while honoring the legacy behind…

-

Can You Borrow Against Your Life Insurance?

Read more »: Can You Borrow Against Your Life Insurance?Life insurance is more than a safety net for your loved ones. It’s a financial tool you can use during your lifetime for both essential and discretionary purchases. With a properly structured participating whole life insurance policy, you can build a cash value, which you can borrow against for any purpose (from repaying a debt…

-

How Borrowing Against Life Insurance Really Works

Read more »: How Borrowing Against Life Insurance Really WorksImagine borrowing money without selling assets, visiting the bank, or navigating complicated approval processes. With a properly structured life insurance plan, you can borrow cash anytime, using your policy as collateral. This financial strategy can help you pay for unexpected life expenses or nice-to-have items, such as a new car or vacation home, with more…

All Articles

-

The Biggest Fears Of Registered Retirement Savings Plans

Read more »: The Biggest Fears Of Registered Retirement Savings PlansIt’s important to know what the main fears of Canadians are about RRSPs to be prepared and well-informed when it comes time to make decisions about your retirement planning.

-

Is A Group RRSP Considered Employee Benefits?

Read more »: Is A Group RRSP Considered Employee Benefits?Group RRSPs are a common but often overlooked employee benefit that can offer a convenient way to save for retirement—especially with employer contributions or matching incentives. While the automatic payroll deductions can simplify investing, there are often eligibility rules, restrictions on access, and limited investment options. Understanding how your group RRSP fits into your overall…

-

Five Things You Should Know About Registered Retirement Income Funds

Read more »: Five Things You Should Know About Registered Retirement Income FundsWhile RRSPs help you grow savings tax-deferred, RRIFs require you to start drawing income and paying taxes, often affecting government benefits and estate planning. Understanding how and when to convert your RRSP into a RRIF is key to avoiding costly surprises.

-

Why you don’t need a professional certification in financial services

Read more »: Why you don’t need a professional certification in financial servicesMany Canadians believe credentials are required to make sound financial decisions, but experience, communication, and a proven track record often matter more.

-

Planning Your Financial independence

Read more »: Planning Your Financial independenceTo achieve financial independence, you have to plan your financial course with care. It is not an easy task since there are no one-size-fits-all formulas that you can follow because the variables keep changing. However, there are actionable steps you can take.

-

What should every Canadian Know about Your Will?

Read more »: What should every Canadian Know about Your Will?Do you want to control the allocation of your property even after your death? Well, a will is an excellent way of achieving this. Creating a will is not a walk in the park. There are several things that every Canadian should know about a will. First and foremost, it’s essential to understand that your…

-

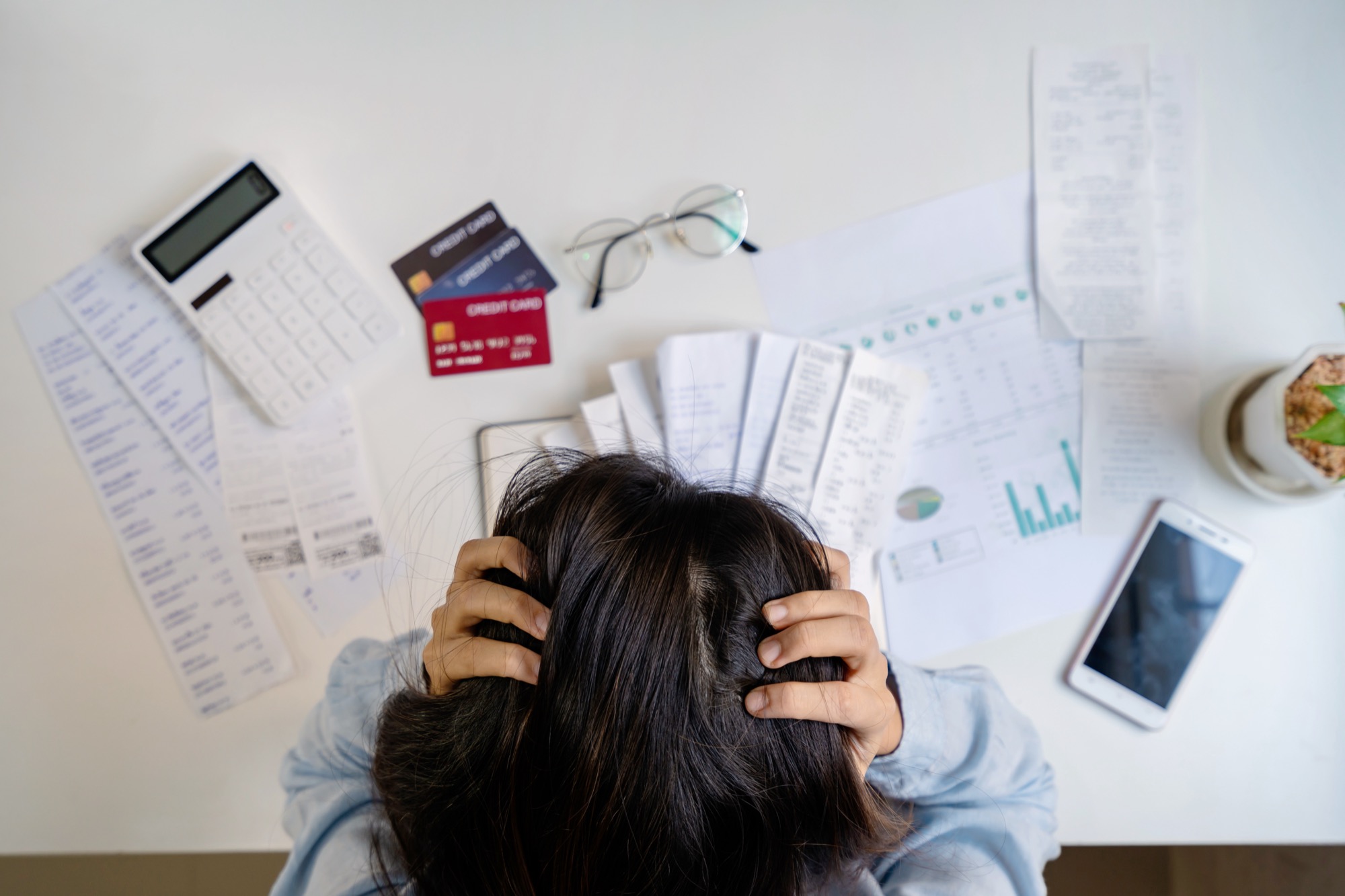

Debt management: Budgets, Options, Consolidation, Creditors

Read more »: Debt management: Budgets, Options, Consolidation, CreditorsDebt management is a process typically spearheaded by a financial counselor who helps individuals who find themselves spiraling in debt, particularly unsecured debts such as credit card debt.

-

What is Family Economics

Read more »: What is Family EconomicsFamily economics isn’t just about budgets—it’s about the decisions that shape your family’s financial future. From youth sports to building a lasting legacy, how you spend today affects what you leave behind tomorrow. Discover how families across Canada are creating long-term prosperity through a new way of thinking: the family banking system.

-

How To Handle Beneficiaries During Divorce

Read more »: How To Handle Beneficiaries During DivorceDivorce is a major life transition—and amid the legal and emotional complexity, updating your life insurance beneficiaries often gets overlooked. Whether your ex is still listed as your primary beneficiary or your children need a trustee, now is the time to ensure your policies reflect your new reality. Learn how to protect your assets and…