Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: Inheritance tax with Ascendant Financial

Read more »: Inheritance tax with Ascendant FinancialWhat is Inheritance tax? The term Inheritance Tax (IHT), stands for an amount that’s payable by a person who has received assets upon another individual’s death. The asset range includes cash, real estate properties, business shares among others. This emphasizes how important it is to understand optimal inheritance tax literature takes into account these factors…

-

Read more »: Insurable interest

Read more »: Insurable interestWhat is Insurable interest? The term “insurable interest” is used to describe the legal and financial interests of a person or company in an insurance policy. It means, in simple terms, that the person or entity buying the insurance has a stake in protecting the insured property or person. The stake is to ensure that…

-

Read more »: Is A Group RRSP Considered Employee Benefits?

Read more »: Is A Group RRSP Considered Employee Benefits?Group RRSPs are a common but often overlooked employee benefit that can offer a convenient way to save for retirement—especially with employer contributions or matching incentives. While the automatic payroll deductions can simplify investing, there are often eligibility rules, restrictions on access, and limited investment options. Understanding how your group RRSP fits into your overall…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

Sorry, but there are no videos in this category. Please check back soon!

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Treating life insurance as an expense could cost you. Henry Wong breaks down a major misconception that permanent life insurance is a specialized asset, but many mistakenly treat premiums as an expense. As he points out, the Income Tax Act clearly states that insurance premiums aren’t deductible. Avoid costly mistakes and make life insurance work…

-

Every major purchase comes down to three choices: lease it, buy it with cash, or finance it. Jason Weiss, a financial strategist, breaks down how business owners can optimize their cash flow while acquiring assets. Instead of tying up capital, strategic financing allows you to keep money moving where it works best. This approach applies…

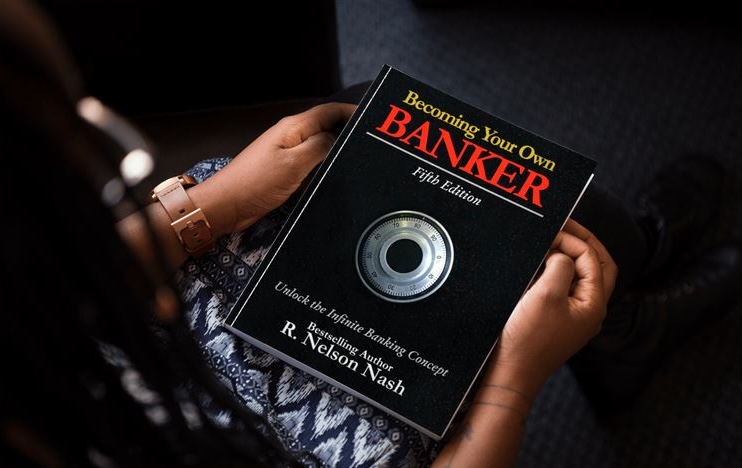

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!